This Report analyzes the market shares, market size, and mergers and acquisitions (M&A) activity in the Heating, Ventilation, and Air Conditioning (HVAC) industry in North America. The market environment for the North American HVAC industry is on a soft trend in the residential sector, while on the other hand, the commercial sector is displaying firmness eclipsing the impact of the residential market so this is a market in which continuous growth is expected.

In this report, we provide an overview of the HVAC market environment and the key HVAC players active in North America, including Japanese player Daikin and U.S. peers Trane Technologies, Carrier Global Corporation, Johnson Controls and Lennox International.

HVAC Market Scope

Air conditioning is also expressed as “HVAC” by combining the initial letters of Heating, Ventilation and Air Conditioning. The HVAC market is broadly divided into two segments: equipment business, which manufactures and sells heating, ventilation and cooling equipment; and solutions business, which provides maintenance and services related to HVAC systems. With interest in the energy management of entire facilities and buildings and energy efficiency increasing in recent years, the relative weight of solutions business, with companies combining HVAC systems from the perspective of maintenance management, has tended to expand in recent years.

Heating, ventilation, and cooling equipment is further subdivided into heat pumps, boilers, purifiers, ventilation fans, dehumidifiers and humidifiers, unit air conditioners, VRF systems, chillers, and portable air conditioners.

.png)

North America HVAC Market Shares

The market shares can be estimated using the HVAC segment revenue of each HVAC company in North America in 2024 relative to the overall market size estimated in the following section. On that basis, Trane Technologies appears to be the market leader in North America, followed by Daikin, then Carrier Global, Johnson Controls and Lennox.

| Ranking | Company | Market Share |

|---|---|---|

| No. 1 | Trane Technology plc | 23.0% |

| No. 2 | Daikin Industries, Ltd. | 19.2% |

| No. 3 | Carrier Global Corporation | 17.7% |

| No. 4 | Johnson Controls, Inc. | 15.2% |

| No. 5 | Lennox International Inc. | 8.9% |

Source: DealLab estimates based on annual reports and disclosures (Jan–Dec 2024, North America HVAC revenue)

-1024x629.png)

Comparing the changes in market share of the top five companies in the ranking of market share (North America) in 2023 and 2024 shows that all companies increased their market share, and the share taken by the top five companies increased.

In the North American HVAC market, the market overall is expanding centered on commercial equipment against the backdrop of vigorous demand for data centers, supported by policy measures such as expanded tax breaks and subsidies for renewable energy and highly efficient equipment based on the recently enacted Inflation Reduction Act.

Comparing the commercial and residential HVAC markets shows that although the commercial HVAC market is tending to growing significantly due to the aforementioned factors, the residential HVAC market is tending to soften.

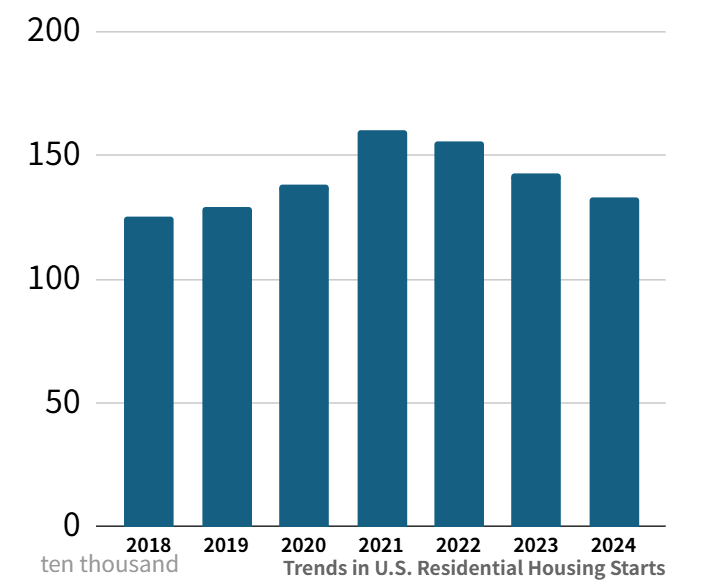

High home loan rates combined with soaring house prices can be raised as the background to this. According to U.S. Department of Commerce statistics, the number of new housing starts declined by 8% year-on-year in 2023 and by about 7% in 2024, and all decreases in the number of units can be seen at all companies. In addition, because the pandemic demand seen from 2020 to 2023 has returned to normal, although the HVAC market overall is growing, this is partially offset by the impact of the housing market.

Trane Technologies has maintained its leading market share of the North American HVAC market in 2024, as in the previous year. The company expanded its market share by 1.9% year-on-year, which compares favorably with the rates of increase of other companies. In the residential sector, the number of reservations and sales declined under the impact of market softness, but sales in commercial market to the large scale facilities and industrial equipment-related facilities, which are the strength of the company, grew at a high rate of more than 20%, so its market share expanded at a rate surpassing that of other companies.

Daikin continued in second place from 2years ago. Although its market share increased by 0.2% year-on-year, the gap with Trane Technologies widened. In the commercial sector, sales of equipment for large-scale properties such as data centers and factories grew, and sales also expanded in solutions business, resulting in sales growing by more than 30% year on year. On the other hand, in the residential sector, the company prepared to switch to equipment using R32, a new refrigerant with less environmental impact, ahead of other companies, but demand for equipment using R32, the current refrigerant, was greater than expected.

Refrigerants, also known as refrigerant gas, are characterized by absorbing the heat around them when they change from liquid to gas, and releasing that heat around them when they change from gas to liquid, and these characteristics are used to adjust the indoor temperature.

Due to the Kigali Amendment to the Montreal Protocol, companies are supposed to reduce the use of refrigerants with high global warming potential (GWP) such as R410A gradually. Because the manufacture and import of certain types of new HVAC equipment using R410A refrigerant (old refrigerant) was prohibited in the U.S. from January 1, 2025, demand for equipment using the old refrigerant increased temporarily from the end of 2023 through the first half of 2024. Equipment using R32 and R454B refrigerants (new refrigerants) with low GWP values are expected to become the mainstay from now on.

Trends in the selection of new refrigerants vary from company to company, as detailed below. Johnson Controls has chosen R454B as its primary alternative to R410A and is adopting it in residential, light commercial and commercial ducted applications. Carrier Global has also reported it has adopted R454B in residential systems.

As mentioned above, Daikin has been servicing R32 equipment since 2024. In the residential unitary segment, the company has spread the superiority of R32 equipment in distribution including its versatility in global use, the convenience due to single-molecule structure, and the ease of collection and recycling, and it aims to expand sales in the ductless segment by expanding its lineup of R32 equipment.

Market Size of the HVAC Industry in North America

Based on various research data laid out below, DealLab estimates the North American HVAC industry was worth $55.1 billion in 2024.

| Year | Market size | Growth Rate |

|---|---|---|

| 2024 | $55.1 billion | 4.5% |

| 2032 | $85.9 billion | 5.7% |

*The growth rate from 2023 to 2024 is calculated based on the actual data for 2023 in our database.

**For 2032, our database has independently calculated the projected Compound Annual Growth Rate (CAGR) from 2024 to 2032.

Various research data referenced are as follows:

According to survey company Market Data Forecast, the industry’s market size was about $51.2 billion in 2024 and it is expected to grow to about $84.1 billion by 2033.

According to survey company Next MSC, the industry’s market size was about $69.3 billion in 2024 and it is expected to grow to about $99.2 billion by 2030.

According to survey company Market Research Future, the industry’s market size was about $50.7 billion in 2024 and it is expected to grow to about $86.6 billion by 2034.

Factors contributing to the expansion of the North American HVAC market include the expansion of demand due to environmental factors such as higher summer temperatures, the introduction of the SEER2 standard (a standard that measures the efficiency of air conditioners), and regulations phasing out the use of refrigerants with high global warming potential, as described above.

Moreover, the expansion of the data center market is also expected to drive the expansion of the HVAC market. According to Fortune Business Research, the North American data center market is expected to grow at a CAGR of 10.9% from 2024 to 2032 to reach $14.9 billion by 2032. Behind this is the increase in cloud demand and the rapid development of artificial intelligence (AI). In particular, AI servers are said to consume several to more than ten times as much power as typical cloud servers so they require high cooling capacity. Further, temperature management is also an area where technological capabilities are required, and it is thought to be an area where technological innovation is advancing at each company.

North American Market from a Global Perspective

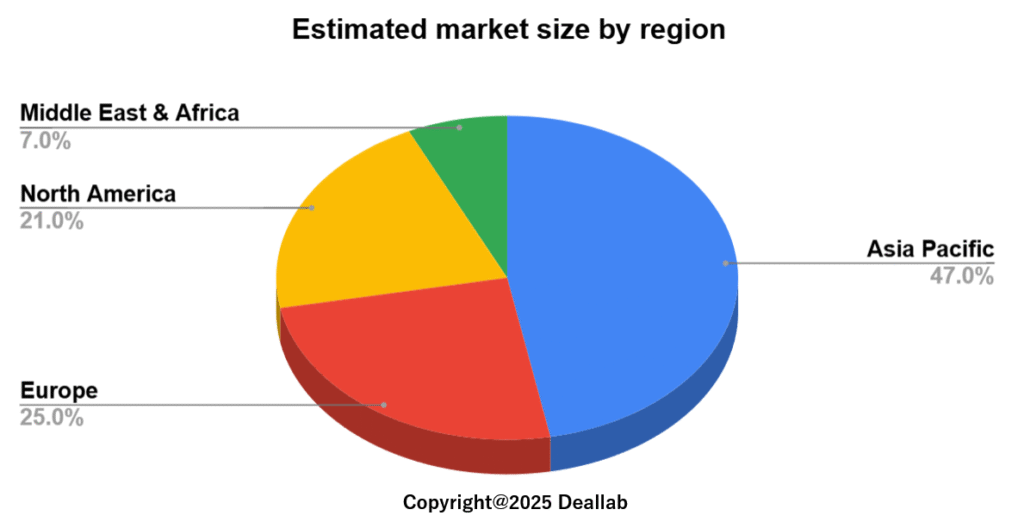

According to Precedence Research, the largest HVAC market is the Asia Pacific, accounting for 47%, or about half of the global market, while the North American market is also important, accounting for more than 20% of the global market.

Source: Data from Precedence Research, processed by Deallab

Analysis of Major Companies in North America

Revenue Breakdown by Region

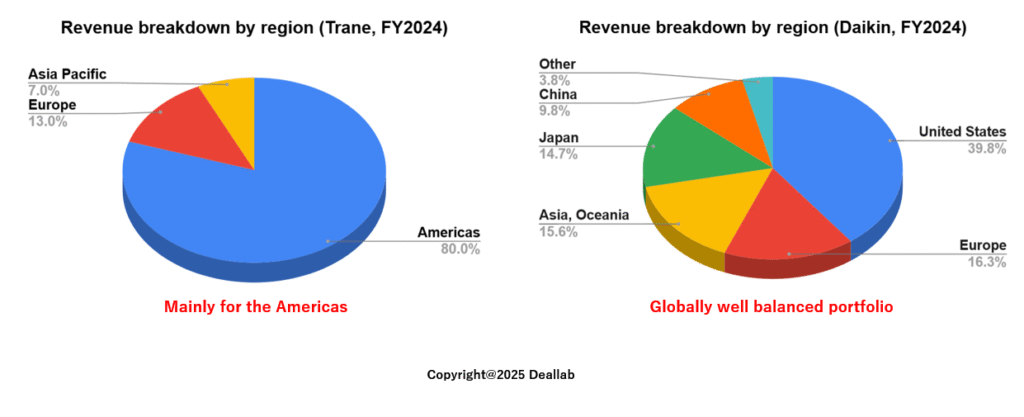

Looking at revenue by region, the largest player, Trane Technologies, focuses on the North American and Central/South American markets, while Daikin also has a high percentage of sales in the U.S., with its large market size, but balances out its business with a presence in China, Japan, and Europe.

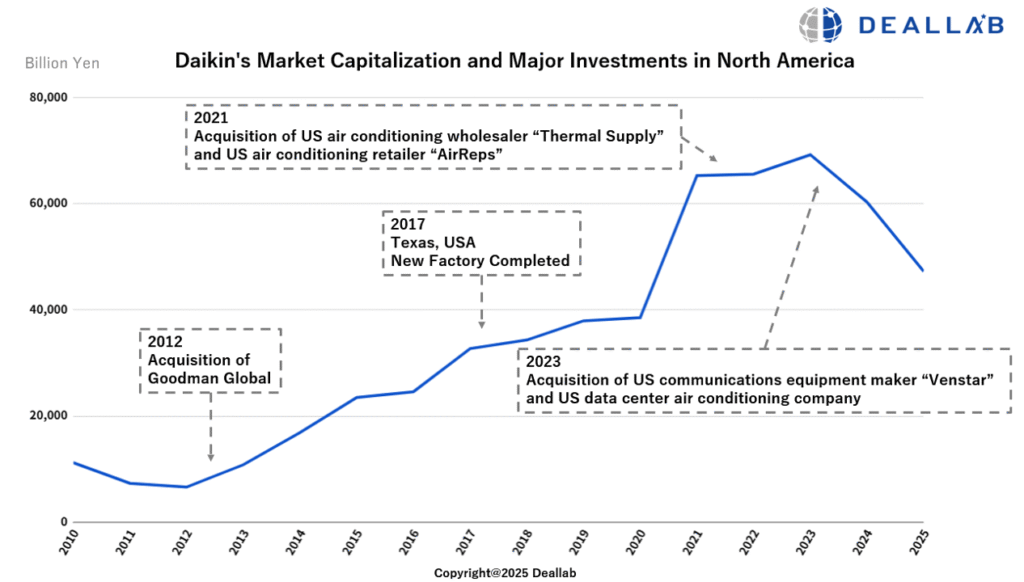

The revenue composition of Trane Technologies indicates that even HVAC giants face challenges to expand globally due to differences in consumer preferences and product technologies in each region. However, Daikin has overcome such difficulties and moved ahead of competitors in successfully developing globally as an HVAC player. Daikin entered the North American market in earnest with the acquisition of OYL in 2007, and its market capitalization has also grown along with its business expansion in North America.

Thirty years ago, around 15% of Daikin’s sales were generated overseas, a significant difference from the ratio of overseas sales in 2024. Most recently, Daikin has expanded its production sites and strengthened sales offices in Southeast Asia, the Middle East, Africa, India, and elsewhere.

- 2022: Established an air conditioner production plant in Indonesia

- 2022: Established an assembly plant in Saudi Arabia, its second country in the Middle East

- 2023: Started construction of a new heat pump heater plant in Poland

- 2023: Established an air conditioning sales company in Cambodia

- 2023: Established a new air conditioner production site in India

- 2024: Built a residential air-conditioning production network in Africa

- 2024: Established a joint venture with the major Taiwanese air conditioning company Leading, etc.

In November 2022, Trane Technologies completed the acquisition of AL-KO Air Technology, a major German air conditioning manufacturer. It acquired MTA of Italy in May 2023 and is expanding its market share outside North America positively.

In 2024, Carrier Global acquired Viessmann Climate Solutions, a major German air conditioning manufacturer, and the acceleration of the global expansion of these companies after Daikin is striking.

M&A Trends at Major North American Companies

In terms of trends in M&A in recent years, as described above, there have been increases not only in direct acquisitions of air conditioning equipment manufacturers, but also in deals that are expected to add value to existing air conditioning functions aimed at the optimization of the energy efficiency of buildings overall.

As an example, the 2022 acquisition of Venstar by Daikin enabled Daikin to offer Venstar’s remote services for air conditioning equipment. The acquisitions of Nuvolo and BrainBoxAI by Trane Technologies in 2023 were also aimed at the improvement of added value to building and facility operations management solutions and the strengthening of the creation of new customers.

In addition, Johnson Controls announced in 2024 that it planned to sell its HVAC business for residential and small commercial properties to Bosch, and with its move to focus on building solutions, it is expected that the restructuring of the industry will advance significantly worldwide.

Major M&A Projects

- 1979 Acquisition of Carrier by United Technologies

- 2007 Acquisition of Malaysian air conditioning manufacturer OYL by Daikin

- 2008 Acquisition of Trane Technologies by Ingersoll-Rand

- 2011 Acquisition of Carrier’s South American operations by Midea Group

- 2012 Acquisition of Goodman Global by Daikin

- 2014 Acquisition of Air Distribution Technologies (U.S.) by Johnson Controls

- 2016 Management integration of Johnson Controls and Tyco

- 2016 Acquisition of Flanders (U.S.) by Daikin

- 2018 Acquisition of Triatek, a manufacturer of airflow solutions, by Johnson Controls

- 2018 Establishment of a joint venture by Mitsubishi Electric and Ingersoll Rand to sell ductless air conditioners

- 2020 Spin-off of Trane Technologies by Ingersoll-Rand

- 2020 Acquisition of air conditioning dealers Abco, Robinson, and Stevens by Daikin

- 2020 Spin-off of Carrier by United Technologies

- 2021 Acquisition of major air conditioning distributor Temperature Equipment (TEC) by Carrier and major U.S. air conditioning distributor Watsco

- 2021 Acquisition of the Fisher Group, which operates HVAC sales and installation businesses in the U.K., by Johnson Controls

- 2021 Acquisition of air conditioning wholesaler Thermal Supply and commercial air conditioning distributor AirReps by Daikin

- 2022 Carrier made Toshiba Carrier its subsidiary (acquisition of Toshiba Carrier by Carrier subsidiary Global Comfort Solutions LLC)

- 2022 Acquisition of FogHorn AI software by Johnson Controls

- 2022 Acquisition of major U.S. telecoms equipment company Venstar by Daikin

- 2022 Acquisition of major German air conditioning company AL-KO by Trane Technologies

- 2023 Acquisition of MTA (Italy) by Trane Technologies

- 2023 Acquisition of Alliance Air Products and CM3 Building Solutions (U.S.) by Daikin

- 2023 Acquisition of AES, a U.S. commercial HVAC service provider, by Lennox

- 2023 Acquisition of Nuvolo, a U.S. facilities management solution provider, by Trane Technologies

- 2023 Sale of commercial refrigeration unit to joint venture partner Haier (China) by Carrier

- 2023 Lennox announced its plan to sell its European HVAC business to an investment fund

- 2024 Acquisition of major German air conditioning company Viessmann Climate Solutions by Carrier

- 2024 Agreement on the establishment of a joint venture by Lennox and Samsung

- 2024 Acquisition of Robert Heath Heating in the UK by Daikin

- 2024 Acquisition of Kylslaget in Sweden by Daikin

- 2024 Acquisition of Johnson Controls’ HVAC business for residential and small commercial properties by Bosch

- 2024 Acquisition of Webeasy (control systems) in the Netherlands by Johnson Controls

- 2024 Acquisition of AI-related company BrainBoxAI by Trane Technologies

- 2025 Acquisition of transportation electrical systems company Addvolt in Portugal by Carrier

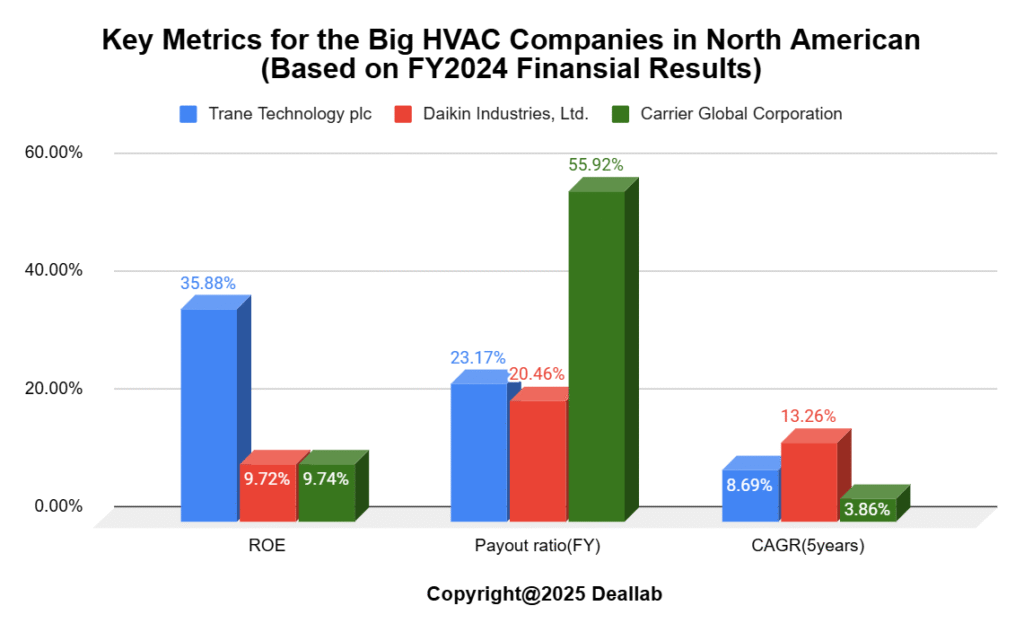

Comparison of Key Metrics of Three Major North American HVAC Companies

The table below summarizes dividend payout ratio, ROE and the revenue growth rates (over the past five years) of Trane Technologies, Daikin and Carrier Global. Daikin has outperformed competitors in terms of sales growth, Carrier Global in terms of dividend payout, and Trane Technologies in terms of ROE.

*Dividend payout ratio is calculated based on TTM as of June 4, 2025.

**ROE is calculated based on net income for the previous fiscal year and the average amount of shareholders’ equity at the beginning and end of the fiscal year.

***Sales growth rate (company overall) is calculated as the compound annual growth rate (CAGR) over the past five years.

Daikin’s sales growth rate far exceeds that of the other companies. This is due to strategic M&A and localized product development and sales strategies. In particular, the North American market is dominated by duct-type air conditioning systems. This has historically been a barrier to entry for Japanese HVAC players who specialize in ductless air conditioning systems. In order to expand its range of locally suitable HVAC equipment, Daikin acquired McQuay (OYL Industries), which was strong in large air conditioning systems, in 2008 and Goodman, which is strong in residential air conditioning equipment, in 2012.

In addition, the company is promoting the introduction of products that combine Daikin’s core strengths in energy saving, inverter and refrigerant technologies with Ducted-type air conditioning systems that are dominant in North America. It appears this is one factor contributing to the steady expansion of the company’s market share.

Since 2020, Daikin has also acquired Abco, Thermal Supply, AirReps, Williams Distributing, Alliance Air Products, CM3 Building Solutions, and other companies. The company is also focusing on strengthening supply capabilities, expanding sales channels, and expansion in the maintenance domain.

Carrier Global’s dividend payout far exceeds that of the other companies. One of the reasons for this is the company’s strategic focus on shareholder value creation, which emphasizes shareholder returns. Its 2025 disclosure document states that the company aims for “free cash flow conversion,” indicating that it intends to use almost all of the cash it earns for shareholder returns and reinvestment. In addition, Carrier Global’s ROE has trended downwards in recent years against the backdrop of the pursuit of business selection and concentration, including the sale of its non-core fire and security business in 2023.

In the North American HVAC market, each company is realizing organic growth while strengthening business and expanding its market share using M&A. On the other hand, trends are apparent in HVAC business including a focus on large equipment, and it is thought that reorganization will accelerate further in the North American HVAC industry from now on due to the promotion of M&A.

Key HVAC players snapshot

Daikin

Daikin is Japan’s leading HVAC manufacturer, founded in 1924. It is one of the world’s top manufacturers of industrial heating and air conditioning equipment. It has expanded its business globally by acquiring Goodman Global, which is strong in duct systems, and OYL, a major air conditioner manufacturer in Malaysia. The company is also engaged in the fluorinated compound and other chemical products business.

Carrier Corporation

Carrier Corporation is a leading U.S.-based HVAC manufacturer. In 2020, Carrier air conditioning operations were spun off from United Technologies, together with elevator (Otis) and aircraft components businesses. The company also has strengths in transportation refrigeration equipment and fire alarms.

Johnson Controls (York International Corporation)

York is a U.S.-based HVAC manufacturer and a subsidiary of Johnson Controls.

Johnson Controls is a U.S.-based company founded in 1885 that provides commercial HVAC control systems, security systems, fire detection systems, and building management services. The company invented the electric thermostat. In 2015, Johnson Controls formed a joint venture with Hitachi Appliances in the HVAC field. In 2016, it merged with Tyco International, which is strong in the fire alarm field. The company operates in 150 countries around the world, offering energy efficiency solutions and various automation businesses. It was strong in the field of automotive batteries but sold the business in 2018.

Trane Technologies

Trane Technologies is a U.S.-based HVAC manufacturer. The company was a subsidiary of Ingersoll-Rand, a U.S.-based manufacturer of transportation temperature control equipment, golf carts, and air compressors, and was spun off as Trane Technologies in 2020.

About Ingersoll-Rand

Ingersoll-Rand, a U.S.-based industrial equipment manufacturer founded in 1871, merged with Gardner Denver, a manufacturer of vacuum pumps, compressors, and other industrial machinery, in 2020. Prior to the merger, the HVAC business was spun off as Trane Technologies.

Top-class companies like Allegion in the security industry and Hussmann in the refrigerated showcase industry (sold to Panasonic in 2015) are spun off from Ingersoll-Rand. It is also strong in compressors and air tools and transport refrigeration equipment. Its golf cart business was sold to Platinum Equity in 2021.

Lennox International

Lennox is a U.S.-based HVAC manufacturer founded in 1895. The company’s strengths lie in the residential and commercial air conditioning as well as commercial refrigeration businesses. In the refrigeration business, Lennox supplies unit coolers, fluid coolers, air-cooled condensers, air handlers and refrigeration rack systems to supermarkets, convenience stores, restaurants, warehouses, and distribution centers.