Deallab analyzes the fertilizer industry’s global market share, market size, and M&As. The page also includes company information on fertilizer manufacturers such as Nutrien, Yara, Agrium, Mosaic, Uralkali, and Israel Chemicals.

Market Share

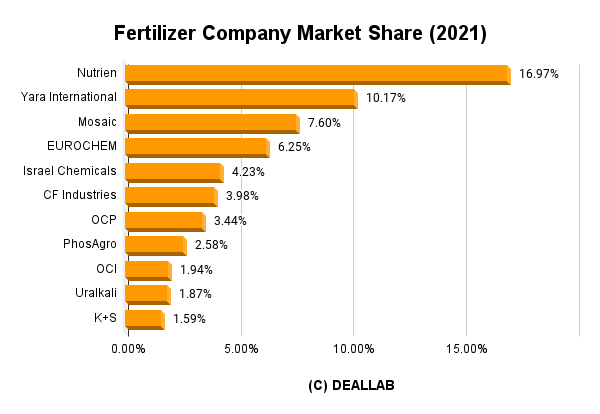

Deallab calculates the global market share of the fertilizer industry in 2021, using the fertilizer companies’ sales in 2021 as the numerator and the fertilizer industry market size as the denominator.

Based on this market share calculation, Nutrien of Canada is in first place, Yara International of Norway is in second place, and Mosaic is in third place.

Fertilizer Company Market Share and Industry Ranking (2021)

| Ranking | Company Name | Market Share |

|---|---|---|

| 1 | Nutrien | 16.97% |

| 2 | Yara International | 10.17% |

| 3 | Mosaic | 7.60% |

| 4 | EUROCHEM | 6.25% |

| 5 | Israel Chemicals | 4.23% |

| 6 | CF Industries | 3.98% |

| 7 | OCP | 3.44% |

| 8 | PhosAgro | 2.58% |

| 9 | OCI | 1.94% |

| 10 | Uralkali | 1.87% |

| 11 | K+S | 1.59% |

Nutrien, formed from the merger of Potash and Agrium, is No.1. In fourth place is Eurochem, based in Switzerland but with Russian capital as a major shareholder. In fifth place is Israel Chemicals, which is based in Israel. In sixth place is CF Industries of the U.S., followed by Morocco’s government-owned OCP in seventh, Russia’s PhosAgro in eighth, and Ukraine’s Uralkali in tenth. Although affected by macroeconomic factors such as crop prices, the fertilizer industry is a growing market, as demand for agricultural products is expected to increase along with the global population in the future.

Market Size

Deallab estimates the global market size of the fertilizer industry was $163.2 billion in 2021, based on various published information. The information Deallab has referred to is as follows.

According to research firm imarc, the market size of the industry was $163.2 billion in 2021 and is expected to grow at a CAGR of 3.9% through 2027, expanding to $203.5 billion by 2027.

In 2020, the industry’s market size is $18.05 billion, according to research firm 360 Market Updates, and is expected to grow at a CAGR of 3.1% through 2026.

According to World Fertilizer, the market size in 2019 is $155.8 billion and is expected to grow at a compound annual growth rate of 3.8% through 2024. According to Global Market Insights, the market is $196.9 billion in 2019. It is expected to grow at a CAGR of 3.2% from 2020-2026.

| Year | Market Size (USDbn) | Grwoth Rate |

|---|---|---|

| 2021 | 163.2 | 3.9% |

| 2020 | 180.5 | 3.1% |

| 2019 | 177.9 | 3.2〜3.8% |

Elements of Fertilizer

The three major elements of fertilizer are phosphate, potash, and nitrogen. The five major elements are phosphate, potassium, nitrogen, plus calcium and magnesium. Canada and Russia are the major producers of potassium, which is the element for stem and trunk growth (over 70% of the world’s production), and this is also the background for the strength of Canadian and Russian fertilizer companies. On the other hand, production of phosphoric acid is also limited to the United States, China, Morocco, Brazil, and other countries.

Fertilizers are made by blending phosphoric acid, potassium, and nitrogen, which are the raw materials, and do not require much technology in processing. In addition, raw materials account for a very high proportion of the cost of fertilizers, and the source of competitive advantage lies in whether or not the company is able to suppress key raw materials such as phosphorus and potassium. Japanese fertilizer companies rely on imports for raw materials and are greatly affected by fluctuations in fertilizer prices and other factors.

M&As

In nitrogen, CF Industries is competing with Yara International for the top spot through M&As. In potassium, Potash acquired Agrium to consolidate its leadership position. In the phosphorus sector, Mosaic acquired Vale’s fertilizer division to become a major player.

- 2004 Norsk Hydro spins off its fertilizer division as Yara International

- 2004 Mosaic was formed through the merger of the fertilizer divisions of major chemical fertilizer manufacturers IMC and Cargill.

- 2013 Mosaic acquires phosphate business from CF Industries

- 2015 Acquisition of OCI’s fertilizer business by CF Industries announced (subsequently abandoned)

- 2016 Acquisition of Agrium by Potash, birth of Nutrien

- 2016 Mosaic acquires fertilizer business from Brazilian resource giant Vale

- 2018 Nutrien Sells SQM Interest to Tianchi Lithium

Improving Farming and Food Science to Fight Climate Change

Handbook Digital Farming: Digital Transformation for Sustainable Agriculture

Fertilizer companies

Nutrien

Nutrien is one of the world’s largest major chemical fertilizer manufacturers, based in Canada, and was created when Potash (Potash Corporation of Saskatchewan), founded by the government of Saskatchewan in 1975, acquired Agrium in 2016.

About Agrium

Agrium is a leading fertilizer manufacturer based in Canada. The company was also involved in the retail of fertilizers and seeds in Canada and North America, but Potash acquired Agrium in 2016 and became Nutrien.

Yara International

Yara International is one of the world’s largest fertilizer manufacturers based in Norway. The company’s strength lies in nitrogen fertilizers such as urea, nitrates, and ammonia. The company is listed on the Oslo Stock Exchange. The company was spun off from Norsk Hydro, a major aluminum producer.

Mosaic

Mosaic is a leading U.S.-based chemical fertilizer manufacturer, formed in 2004 through the merger of the fertilizer divisions of IMC, a major chemical fertilizer manufacturer, and Cargill. The company has strengths in phosphate fertilizers and potash, and in 2016 acquired the fertilizer business from Brazilian resources giant Vale. Among fertilizers, it has one of the largest global shares in the phosphoric acid industry and is one of the leaders in potassium carbonate, along with Potash and Uralkali.

OCP

OCP is a fertilizer manufacturer based in Morocco. The company’s strength lies in phosphoric acid. It is a wholly owned subsidiary of the Moroccan government.

CF Industries

CF Industries is a North American-based fertilizer giant that in 2015 announced the acquisition of part of the fertilizer business of phosphorus giant OCI, but decided against the deal. The company is strong in nitrogen fertilizers.

Uralkali

Uralkali is Russia’s leading potassium producer. It is listed on the Russian stock exchange.

Belaruskali

Belaruskali is a leading state-owned potassium producer based in Belarus.

Israel Chemicals

Israel Chemicals is a major fertilizer company based in Israel. The company is strong in the production of potash and phosphoric acid. The company mines and produces magnesium through its subsidiary Dead Sea Magnesium.

K+S

A fertilizer and salt manufacturer based in Germany. In the salt business, the company acquired the salt business from Belgium’s Solvay in 2000, followed by the acquisition of U.S. salt giant Morton Salt (Morton Salt) in 2009 to expand salt production. The fertilizer division is strong in potassium fertilizers and has expanded its business by integrating with BASF’s fertilizer division.

EUROCHEM

EUROCHEM is a fertilizer manufacturer based in Switzerland. The company is strong in the production of nitrogen and phosphoric acid. Its major shareholder is Andrey Melnichenko, a wealthy Russian man.

PhosAgro

PhosAgro is a fertilizer company based in Russia. The company’s strength lies in phosphate-based fertilizers.

OCI

OCI is a fertilizer manufacturer based in the Netherlands. Besides fertilizers, the company also produces methanol and biomethanol.