Deallab analyzes global market share, revenue ranking, market size, and mergers and acquisitions (M&A) of seed companies. Also includes an overview of seed companies such as Syngenta, Monsanto, Vilmorin, and Corteva Agriscience.

Market Share

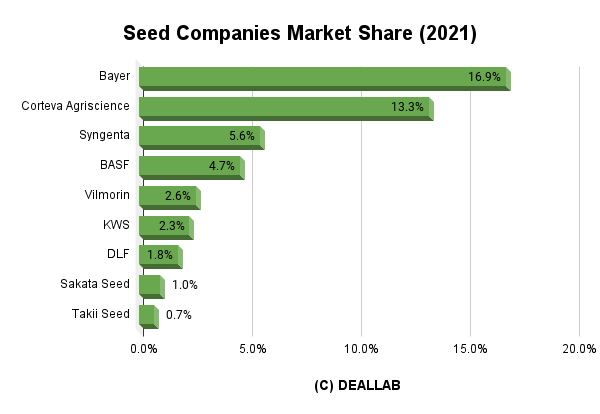

Using the 2021 sales of the seed company companies as the numerator and the market size as the denominator, a simple calculation of the global market share of the seed and seed industry in 2021 shows Bayer in first place, Corteva Agriscience in second place, and Syngenta in third place.

Seed Companies Global Market Share in 2021

| Ranking | Company Name | Market Share |

|---|---|---|

| 1 | Bayer | 16.9% |

| 2 | Corteva Agriscience | 13.3% |

| 3 | Syngenta | 5.6% |

| 4 | BASF | 4.7% |

| 5 | Vilmorin | 2.6% |

| 6 | KWS | 2.3% |

| 7 | DLF | 1.8% |

| 8 | Sakata Seed | 1.0% |

| 9 | Takii Seed | 0.7% |

Bayer became the world’s No. 1. The acquisition of Monsanto has made it the world’s No. 1 in the seed field. After the acquisition, Bayer settled the Roundup and other lawsuits. 2nd place went to Corteva Agriscience, formed by the merger of Dow AgroScience, the seed company of Dow Chemical, and Pioneer, the seed company of DuPont. Corteva Agriscience is independent from DowDuPont and is promoting global expansion in the seed field.

In third place is Syngenta, which was acquired by ChemChina, a major Chinese chemical company. In fourth place is BASF, which acquired the seed business that was requested to be sold by the authorities following Bayer’s acquisition of Monsanto. In fifth place is Vilmorin of France. In sixth place is KWS of Germany, followed by DLF of Denmark in seventh place and Sakata Seed of Japan in eighth place.

Market Size

Deallab estimates the market size of the seed industry to be $63 billion in 2021.

According to the research firm MarketsandMarkets, the market for this industry is expected to be worth $63 billion in 2021, and is expected to grow at a CAGR of 6.6% through 2026. According to the research firm Research and Markets, the market will be worth $55.4 billion in 2019.

| Year | Est. Market Size(USDbn) | Growth Rate |

|---|---|---|

| 2021 | 63 | 6.6% |

| 2020 | 68 | 7% |

| 2019 | 55.4 | – |

M&A

There has been continuous M&As by seed giants to expand their scale and acquire seed technologies in order to invest in R&D upfront.

- 1996 Monsanto’s acquisition of Agracetus

- 1998 Monsanto’s acquisition of Cargill’s seed division

- 1999 DuPont acquisition of Pioneer

- 2001 Acquisition of Purina Mills by Land O’Lakes

- 2004 Syngenta’s acquisition of Advanta

- 2004 Syngenta’s acquisition of Golden Harvest Seeds

- 2005 Monsanto’s acquisition of Seminis

- 2012 Syngenta’s acquisition of Devegen

- 2013 Syngenta’s acquisition of MRI Seed

- 2015 Acquisition of Syngenta by China Chemical

- 2016 Bayer’s acquisition of Monsanto

- 2018 Sale of vegetable seed business by Bayer to BASF

- 2020 Syngenta’s acquisition of Italian biostimulant Valagro

Seed Money: Monsanto’s Past and Our Food Future

March Against Syngenta: Monsanto’s Swiss Twin Unmasked

Seed companies

Bayer

Bayer AG is a global pharmaceutical and chemical manufacturer based in Germany, founded in 1863 by Friedrich Bayer. It is best known for the invention of aspirin. During World War II, the company formed IG-Farben with BASF and Hoechst. After the war, the company became independent as Bayer and has made numerous acquisitions and divestments. In 2015, the company spun off and spun off its Material Science division as Covestro. In the Agrochemicals and Seeds business, the company acquired Monsanto in 2016, putting it one step ahead of the Big Four agrochemical companies. It is also a leader in the seeds sector. Note that major flavor and fragrance company Simrise was created in 2002 through the merger of Haarmann & Reimer and Dragoco, which met as subsidiaries of the company.

Corteva Agriscience

Corteva was created in 2019 as a result of the 2015 business merger between Dow Chemical and E.I du Pont de Nemours, two of the world's leading chemical companies, when the agrochemical subsidiaries of the two companies merged their operations. Dow Chemical's agrochemicals business was Dow AgroSciences, which is a continuation of Rohm and Haas of the United States. The company's agrochemicals business includes corn, soybeans, sunflower, wheat and other seeds, as well as herbicides and insecticides.

About Dow

Founded in 1897 by Herbert Henry Dow, Dow is one of the world's largest integrated chemical manufacturers based in the United States. Its ancestor businesses were bleach and potassium bromide. The company later grew through acquisitions of Union Carbide and Rohm and Haas, and in 2015 merged with U.S. peer DuPont, which was spun off in 2019 into the new Dow for materials, DuPont for specialty industrial materials, and Corteva AgriSciences for agrochemicals. Silicones are developed by Dow Silicones. The company also has strengths in coatings, plastics, and acrylic raw materials and methyl methacrylate.

About DuPont

E.I du Pont de Nemours (E.I du Pont de Nemours) is one of the world's largest chemical manufacturers, founded in 1802 by Frenchman Elleter Irenaeus du Pont de Nemours. 2015 saw the company merge with U.S. peer Dow Chemical, but its specialty industrial materials business was spun off into a newly formed company. In 2011, DuPont acquired Danisco, a leading food ingredients company based in Denmark, to strengthen its food ingredients business in the Nutrition & Bioscience segment, which will be merged with IFF, a leading flavor and fragrance company, in 2019. The company became an integrated food ingredients company. The water treatment membrane business is developed through DuPont Water Technology, which is strong in RO membranes.

Syngenta

Syngenta is a global agribusiness based in Switzerland, formed in 2000 through the merger of the agribusinesses of Novartis and Zeneca. The company has strengths in agrochemicals and seeds; it was acquired by the state-owned Chinese chemical company ChemChina in 2016.

ChemChina

China National Chemical Corporation (ChemChina) is a joint venture between China National Blue Star Corp (Blue Star), founded by Ren Jianxin, and China Haohua Chemical Industrial Corp. (Haohua), a Chinese government-affiliated chemical manufacturer. The Chinese government owns 100% of its shares. Since 2016, Mr. Ning Gao Ning has been CEO of Sinochem and ChemChina, which will merge in 2021 with Sinochem, a state-owned chemical company, and become part of Sinochem China Holdings.

Limagrain

It is an agricultural cooperative group based in France. The seed sector is developed through the acquired company Vilmorin. In the Americas, KWS and AgReliant Genetics, a 50/50 joint venture, operate in the corn seed sector.

Land O’Lakes

It is an agricultural cooperative group based in the United States. It is a major player in the fertilizer and seed fields. Seeds and seedlings are sold under the WinField brand.

KWS

A seed company based in Germany. It is listed on the Frankfurt Stock Exchange. In the Americas, the company is developing corn seeds in collaboration with Limagrain/Vilmorin.

Sakata Seed

A major Japanese seed and seedling manufacturer. It boasts a high global market share for broccoli, lisianthus, and pansy seeds.

Takii Seed

Japan’s leading seed and seedling manufacturer. Founded in the Edo period. It boasts a large share of the world market for ornamental sunflowers and habotanes.

DLF

A seed company based in Denmark, renamed from DLF-TRIFOLIUM. It is a privately held company owned by Danish farmers.