The page analyzes the global market share, market size and industry ranking of the cinical laboratory industry. It also provides an overview and trends of key clinical testing companies such as LabCorp, Sonic Healthcare, Quest Diagnostics, Synlab, and H.U. Group.

Market share of the clinical laboratory industry

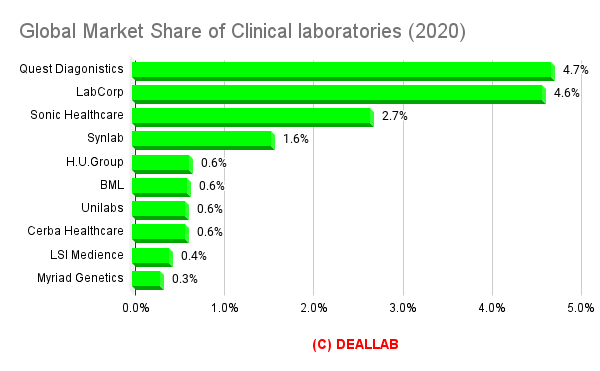

Using the latest available revenue of clinical laboratories as the numerator and the market size, which will be discussed later, as the denominator, a simple calculation of the market share of the clinical laboratories industry in 2020 shows Quest Diagnostics in first place worldwide, LabCorp in second place, and Sonic Healthcare in third place.

Global market share and industry ranking of clinical laboratories (2020)

- No1 Quest Diagonistics 4.7%

- No2 LabCorp 4.6%

- No3 Sonic Healthcare 2.7%

- No4 Synlab 1.6%

- No5 H.U.Group 0.64%

- No6 BML 0.62%

- No7 Unilabs 0.6%

- No7 Cerba Healthcare 0.6%

- No9 LSI Medience 0.4%

- No10 Myriad Genetics 0.3%

Even the largest company, Quest Diagnostics, has a market share of less than 5% – a fragmented market. In addition, many hospitals have their own clinical laboratories, making it difficult for clinical laboratories to expand their business. The No. 1 and No. 2 companies in terms of market share provide services mainly in the U.S. The No. 2 company, LabCorp, is strengthening its non-clinical testing business by strengthening its CRO business, etc. The No. 3 company is Sonic Healthcare of Australia, which is unique in that it operates in English-speaking countries other than Australia. The fourth and seventh are Synlab and Unilabs in Europe. In fifth and sixth place are H.U. Group (formerly Miraca Group) and BML, two of Japan’s leading clinical laboratories.

Market size

DEALLAB uses data published by research companies and other sources to estimate the 2020 global market size of the clinical laboratories industry at $200 billion. According to the Investor & Analyst Day 2018 published by LabCorp, the size of the clinical laboratory market in 2017 was $200 billion. according to the data from the company’s Healthcare Conference in January 2019, the contract laboratory market in 2018 was approximately $80 billion in the U.S. and $100 billion outside the U.S. and $100 billion outside the U.S.

What is clinical laboratories?

A clinical examination is a test performed before a doctor examines a patient’s condition or decides on a course of treatment. The former is performed by taking a sample of the patient’s blood or organs, while the latter is an electrical or imaging examination of the heart or other organs.

The business flow of clinical examination

- Physicians order laboratory tests on patients for diagnosis and treatment

- Specimens are collected from patients

- Transport specimens to a clinical laboratory

- Manage specimen information

- Specimen testing in the lab

- Diagnosis & reporting of test results by pathologist

- Report results to patient

Precedent M&As

Increasingly, PE funds are acquiring clinical testing companies.

2021 Quest Diagnostics sells Q2 Solutions to IQVIA Holdings

2019 Sonic Healthcare acquires Aurora Diagnostics

2016 APAX acquires Unilab

2015 Cinven acquires SynLab

Overview of major clinical laboratories

Quest Diagnostics

Quest Diagnostics is one of the world’s largest clinical testing companies based in the United States. It competes with LabCorp. Outside of the U.S., the company has operations in the U.K., Mexico, and Brazil. The company was founded in 1967. During the course of the company’s history, it became a subsidiary of Corning, a major glass manufacturer, but was spun off as an independent company in 1996. The company is listed on the New York Stock Exchange. The company estimates that the patients it serves account for about one-third of the U.S. adult population on an annual basis, and that it serves about half of all U.S. physicians and half of all hospitals. In addition, more than 30 million molecular diagnostic and antibody serology tests were performed in 2020 to assist in the detection of immune responses in novel coronavirus testing.

LabCorp

LabCorp is one of the world’s largest clinical testing companies based in the U.S. Roche BioMedical was founded in 1978 as Roche BioMedical and merged with National Health Laboratory in 1995 to form its current name. In addition to the U.S., it has operations in China, Japan, the U.K., Singapore, etc. In 2015, it acquired the non-clinical business of Covance, a major contract research organization (CRO), and in 2019, it acquired the non-clinical business of Envigo, a major CRO in the U.K. In 2020, it became the first laboratory in the U.S. to start PCR testing for new coronaviruses.

Sonic Healthcare

Sonic Healthcare is a clinical laboratory company based in Australia. It has operations in countries such as Australia, the United Kingdom, New Zealand, the United States, Germany, Switzerland, and Belgium. The company also provides diagnostic imaging and primary care services in Australia. The company tests more than 115 million patients annually.

SynLab

SynLab is a German-based clinical laboratory company. The company has a presence in South America, the Middle East, and Africa, as well as in Europe, including France, Italy, and Switzerland. In 2015, the company merged with France’s Labco under the leadership of investment fund Cinven. The company also operates an environmental testing business and went public in 2021.

Unilabs

Founded in 1987, Unilabs is a Swiss-based clinical laboratory that merged with Capio in 2007 and now operates in France, Sweden, Portugal, the Czech Republic and other European countries, as well as the Middle East. It is also developing diagnostic imaging. The company is owned by Apax Partners, an investment fund.

H.U. Group Holdings

Miraca Group has changed its name to H.U. Group Holdings in 2021. The company is based in Japan and its core business is contract clinical testing and laboratory reagents. The clinical testing business is led by its subsidiaries SRL . BML and LSI Medience, a subsidiary of Panasonic Healthcare Holdings (PHC Holdings), are the big three in clinical testing in Japan. Fujirebio is the main supplier of test reagents.

Cerba Healthcare

Cerba is a France-based clinical testing company founded in 1967 and acquired by investment funds such as Partners Group in 2017.

LSI Medience

LSI Medience is a Japanese clinical testing company. It is a group company of PHC Holdings, which is a spin-off of Panasonic’s health care business and has strengths in blood glucose monitoring systems, ultra-low temperature freezers, and medical computers.

Myriad Genetics

Myriad Genetics is a U.S.-based molecular diagnostics laboratory founded in 1992. Its strength lies in diagnostic services that identify important disease genes.

Other major clinical laboratories include Exact Sciences, which specializes in colorectal cancer testing, OPKO Health, which specializes in blood tests for prostate cancer, and NeoGenomics Laboratories, which offers genetic testing for cancer. NeoGenomics Laboratories is a major clinical testing company.

Summary

- The market size is around $200 billion.

- Quest Diagnostics, LabCorp, and Sonic Healthcare are some of the major companies in the market.

- The top three companies have a combined market share of about 10%, and each region is dominated by major clinical companies.

- Private equity is aiming to build a platform of clinical laboratories across regions through acquisitions.

- As part of the utilization of clinical data, we can expect to see the emergence of clinical technology through the integration of data processing companies, as in the case of the merger between Bioclinica and ERT.